Our approach

Every transformation is unique. Prior to starting a transformation, we agree the scope and customize our approach to align with the organization’s specific needs. While leveraging our proven methodology and finance transformation toolkit, we maintain a pragmatic stance, applying only the parts that are valuable.

Our way of making transformations work is flexible and successful. After establishing the scope, we distinghuish four phases and focus on four workstreams. It’s not strict – some parts can move quickly (we are always on the lookout for quick wins), while others take their time. The importance of each workstream might change in different parts of the program, keeping things adaptable and practical. Via our transformation toolkit, we leverage accelerators, templates, best practices, and case studies to support and enhance the transformation process.

Scope

At the start we first establish the scope. This can be a specific functional area (or department), or Finance as a whole. We have hands-on transformation experience in Purchase-to-Pay, Order-to-Cash, Record-to-Report, Financial Planning & Analysis, Tax, Treasury and Risk. We also support in newer areas of Finance, such as FinTech.

Phases

The four phases ensure the target operating model aligns with the strategy. Transformations are dynamic; for example, designs may change during testing or implementation if they’re not practical. Strategies can shift mid-program due to unexpected circumstances. Nevertheless, the four phases provide essential structure and guidance, proving adaptable even in organizations operating through agile principles.

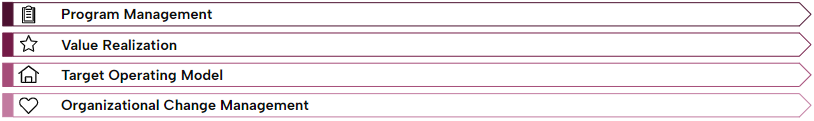

Workstreams

We organize our transformation programs along four key workstreams. Size and emphasis on each of the workstraems varies by transformation, but the purpose of each is the following:

- Program Management: Orchestrating the journey with clear governance, transparent decision making at the right level, status reporting, risk management, resource allocation, budgets, timelines, quality assurance and interdependencies

- Value Realization: Defining and tracking both qualitative and quantitative benefits to ensure the realization of value throughout the transformation program.

- Target Operating Model: Identifying, designing and implementing the operating model enablers required to achieve the Finance vision and ambition. Explore our Finance Transformation methodology for a breakdown of these enablers.

- Organizational Change Management: Guiding the organization through the change by managing various aspects such as workforce transition, change management, communications and training.

Transformation Toolkit

In our transformation toolkit, built on extensive experience, we leverage accelerators, templates, best practices, and case studies to enhance and expedite the transformation process. This proven toolkit saves valuable time by eliminating the need to develop everything from scratch, ensuring efficiency and effectiveness in our approach.

How we work

What makes us stand out is our pragmatism. We work with our clients to get the transformation delivered, without creating massive transformation teams. The following 9 points below summarize how we work: